Robinhood tax calculation

Though you can file your Robinhood taxes separately using your Consolidated 1099-B if youre using any other crypto. Koinly is a Robinhood crypto tax reporting tool.

Robinhood Taxes Explained How To File Robinhood Taxes On Turbotax Youtube

Home appreciation the last 10 years has been -23.

. When asked to enter your bank name enter Robinhood -. Effortlessly calculate your Robinhood crypto taxes and generate the right tax reports to send to your tax authority. Depending on how many trades you make during the year your.

The median home cost in Fawn Creek is 68300. Use code BFCM25 for 25 off on your. Does Robinhood calculate fees and taxes over the total gainloss or per-transaction.

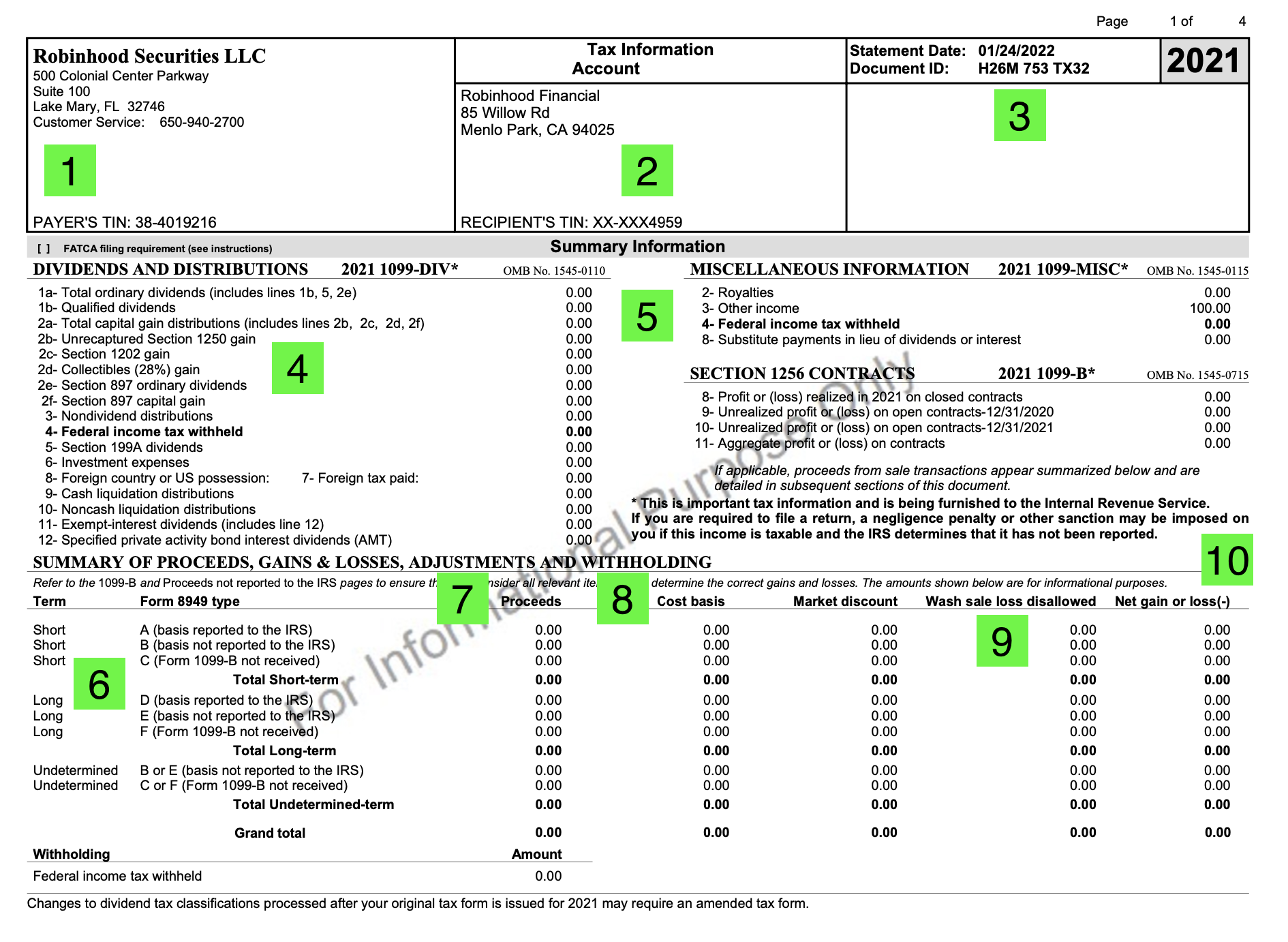

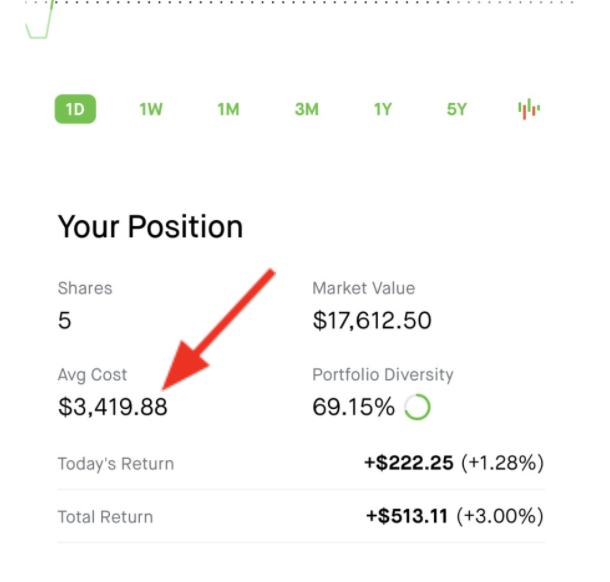

This calculation resets when you close out of a position in its entirety 0 shares. Calculate and prepare your Robinhood taxes in under 20 minutes. Robinhood provides you with a 1099-B tax form just like every other broker.

The US average is 46. 5 to 2877 on Jan. The 1099-B form is what you need to submit to the IRS so that they can keep track of your capital.

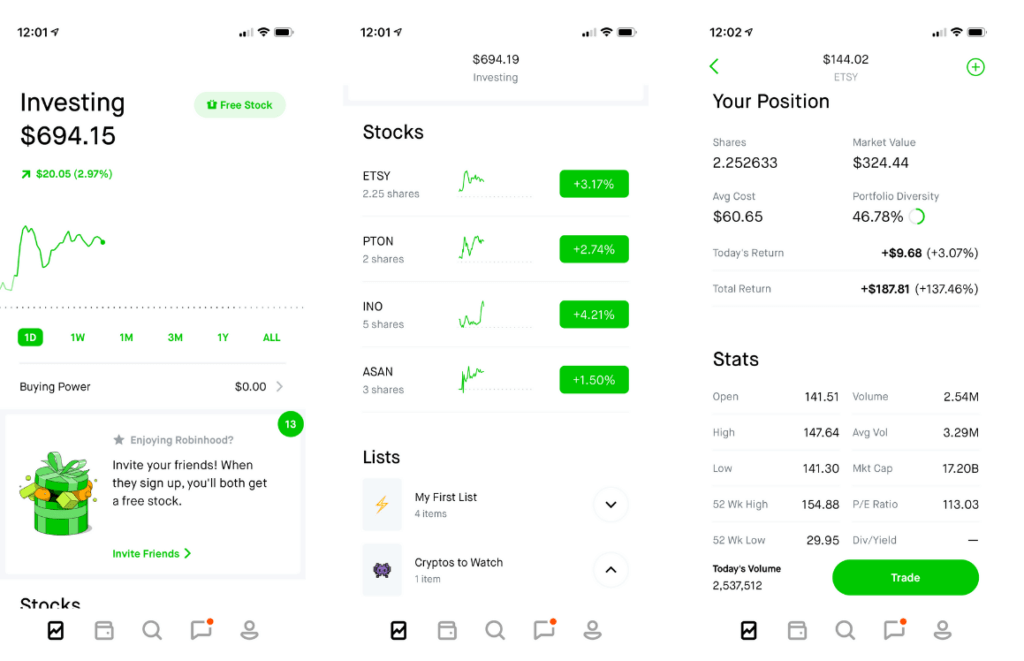

If you sold a stock or received more than 10 dollars in dividends Robinhood will provide you with the necessary tax forms in February. To upload your 1099 to TurboTax. Stocks and cryptocurrencies that you sell through Robinhood get reported on the Form 1040 Schedule D.

Robinhood users may also. Improve this question. Photo from Unsplash Originally Posted On.

Gross income is the sum of all income you earn in a given tax year including. Any information found on Forms 1099-DIV 1099-MISC 1099-INT and 1099-B. How to Connect Robinhood Crypto and Koinly.

State taxes may vary. Robinhood established in 2015 was one of the first online applications to offer free stock trading to users with no commissions or brokerage fees. - The Income Tax Rate for Fawn Creek is 57.

Log in to TurboTax and navigate to the screen for Stocks Mutual Funds Bonds Other. Learn how to access Robinhood tax documents and how you can use them to file your returns using ZenLedger. If you are an employee you can apply for help to decide whether you need to give your employer a new form W-4Checking your withholding can help protect against.

Reinvested dividends DRIP and fractional buys are also included in the calculation on a weighted basis. Gross income and taxable income often go hand in hand but there are important differences. You need to pay tax on your GAINZ not the cash.

The US average is 73. Remember capital losses may help offset capital gains. Home Appreciation in Fawn Creek is up 49.

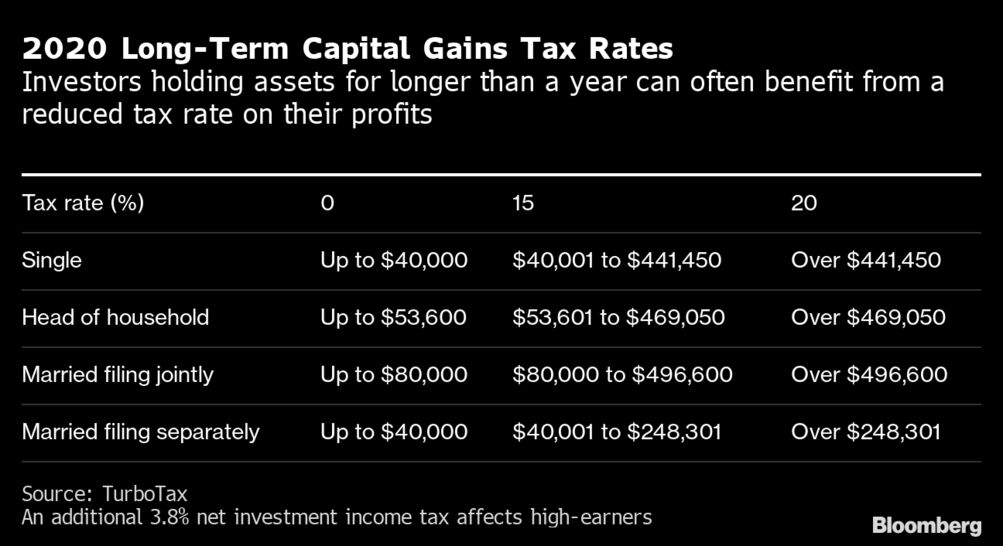

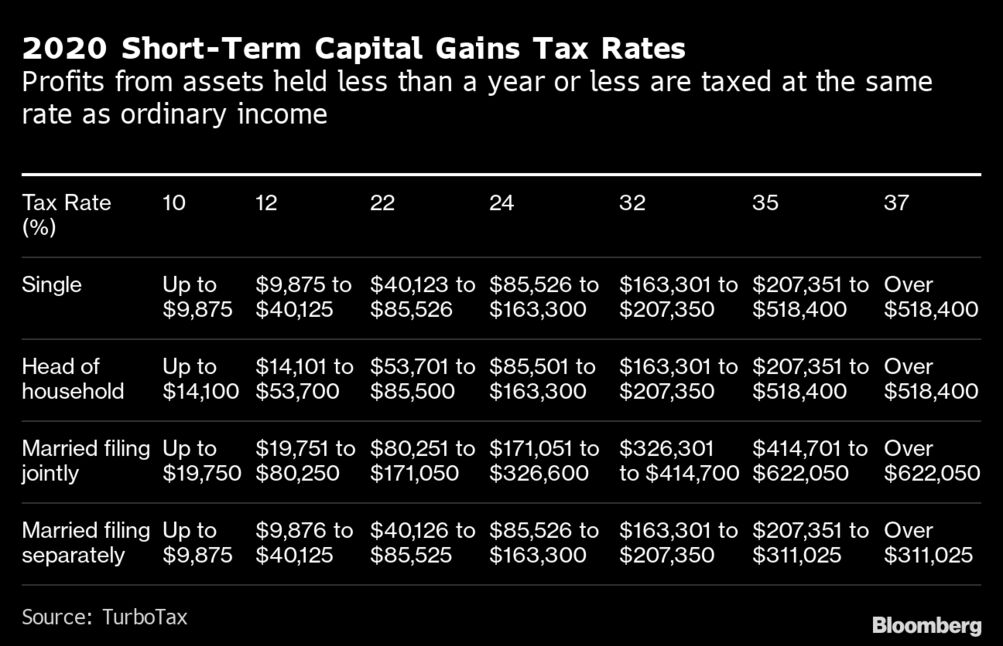

As a Robinhood client your tax documents are summarized in a consolidated Form 1099. The tax will now range from 0 to 20 depending on the investors annual income. Sum of all the money received from selling the shares - Sum of all the money spent on the trades EXCLUDING the ones you still hold Net.

BlackBerry an enterprise software company that used to make smartphones vaulted from 656 on Jan. Tax Rates for Fawn Creek - The Sales Tax Rate for Fawn Creek is 85. Import trades automatically and download all tax forms documents for Robinhood easily.

Taxes stocks broker online-brokerage losses.

Robinhood What To Know Before Investing Nextadvisor With Time

Robinhood Fees

Bemoneyaware On Twitter Investing Robinhood App App

Robinhood Lets You Lend Out Your Stocks For Extra Cash Protocol

Robinhood Citadel Partnership Likely To Draw Scrutiny After Gamestop Trading Halt The Washington Post

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg

Robinhood S New Stock Lending Feature Provides Passive Recurring Income From Your Investments Gobankingrates

With Fraud Growing Robinhood Becomes Latest Fintech To Block Customers From Transferring Money From Certain Banks

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg

Robinhood Tax Documents Tax Reporting Explained Zenledger

How Robinhood Makes Money Cb Insights Research

How To Read Your 1099 Robinhood

How Do You Pay Taxes On Robinhood Stocks Picnic S Blog

Etf Vs Mutual Fund Which Is Better For You Finpins Mutuals Funds Mutual Investing Apps

How To Read Your Brokerage 1099 Tax Form Youtube

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg

Average Cost Robinhood